what is an open end equity lease

The lender is responsible for any. This works well for employers since the cost of the vehicles can be written-off or expensed.

Open End One-month LIBOR 50 percent.

. An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease. The lease terms in a. Pass the journal entries in books.

Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease. A lease contract for a car allows you to drive the car make payments for a certain number of months and then turn the car back in to the leasing company. What is an open ended equity lease.

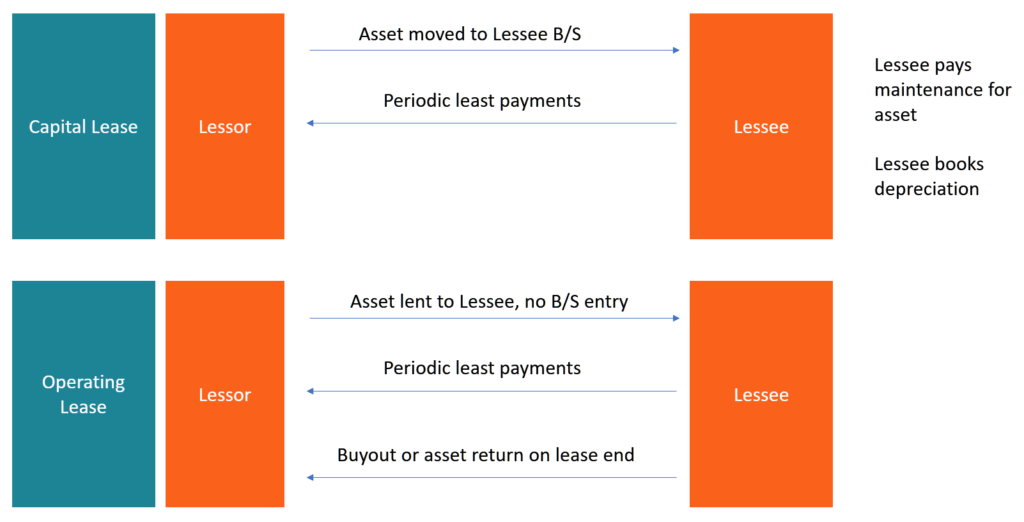

Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal. In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible. In a closed-end lease the leasing company takes on the risk of any additional depreciation.

He will pay the bill if the depreciation is worse than expected. You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for. Open-End TRAC Terminal Rental Adjustment Clause Lease.

When you lease a car you dont own it unless you buy it at the end of the term. Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule.

However it is possible in some cases and we can explain how this can happen. Lease Term Open-end leases carry a shorter term and usually last a minimum of one year but this type of lease can be extended on a month-to-month basis. What is an open-end lease.

Get ALease Agreement Using Our Simple Step-By-Step Process. CLOSED END LEASE COST COMPARISON. This type of lease is also known as a finance lease which as the name implies permits the lessee to determine the vehicles service life after a short minimum term usually 12 months.

Closed End 18 percent per month. This could amount to a significant sum of money if the market value of your vehicle has dropped or you drive many more miles than expected. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

This happens when the lessee drives less than the mileage allotted. A closed-end lease is a rental agreement that puts no obligation on the lessee to purchase the leased asset at the end of the agreement. In open-end leases you are responsible for paying any difference between the estimated lease-end value the residual and the actual market value at the end of the lease.

Lets take a closer look at the two most common options available to commercial fleets. In an open-end lease the lessee agrees to a minimum term thats. When you lease a car youll usually be offered a closed-end lease.

The dealer will refer to this value as the residual value. Understanding Lease Equity. This translates to higher lease-end residual values which in turn translates to lower monthly lease payments.

After this period the lease may be terminated at any time without penalty. Lets walk through a lease accounting example. Open End 20 percent per month.

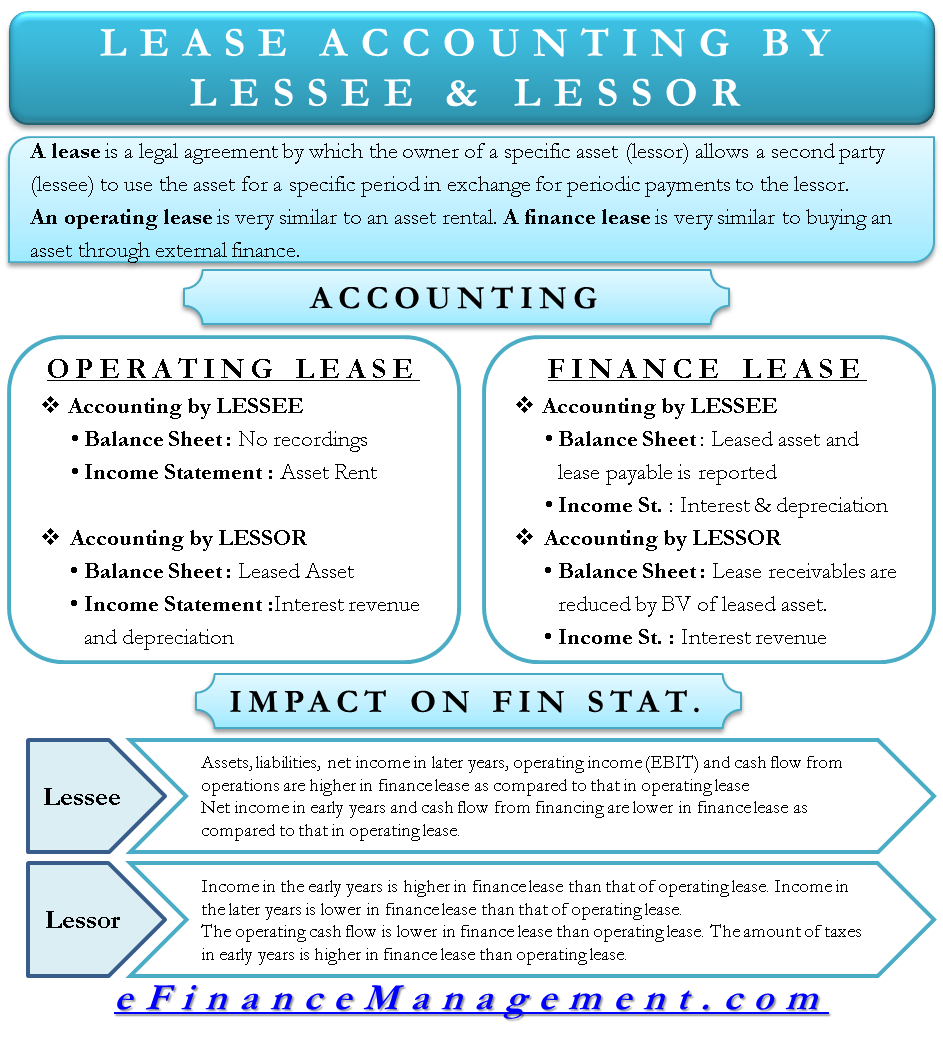

At the end of the lease the equipment will revert to the lessor. The employer takes all the financial risk. On January 1 2017 XYZ Company signed an 8-year lease agreement for equipment.

Ad Answer Simple Questions to Make A Lease Agreement On Any Device In Minutes. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement amounting to t. We just have to think of transport and courier companies they prefer to amortize the real cost of depreciation instead of paying.

Open-end leases also exist and are most often used in the case of commercial business lending. Ford Taurus with standard fleet equipment. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk.

Vehicle used 36 months60000 miles. In most open-end leases you are also entitled to any refund if the actual. If you need a new pickup truck with low monthly payments a closed-end personal lease will be the answer not an open-end lease.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital. To lease a truck for personal use is no different than leasing a car minivan or SUV.

This type of lease is also known as a finance lease which as the name implies permits the lessee to determine the vehicles service life after a short minimum term usually 12 months. Read more at the end of useful life is nil. The lease contract spells out the framework of the deal at the end of the lease including the projected value of the car.

Open End 36 months. An open-end lease is a bigger gamble for the lessee who is accepting more of the risk. This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages.

The lease term was for 6 years and the interest rate stood 12. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began. Closed End Prime 10 percent.

An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing. With The Equity Group you can expect the best. The open-end lease puts all the financial risks on the lessee.

Open- and closed-end leases. The monthly lease payment at the end of each month is 200. Annual payments are 28500 to be made at the beginning of each year.

What Is The Difference Between An Open Vs Closed Lease

Lease Accounting Operating Vs Financing Leases Examples

Capital Lease Vs Operating Lease What You Need To Know

What Is The Difference Between An Open Vs Closed Lease

What Is The Difference Between An Open Vs Closed Lease

Open Vs Closed End Leases What To Know Credit Karma

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

Bsq The Only Goal Setting Framework You Will Ever Need Social Media Social Strategy Social Media Marketing

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

Hsbc Mutual Fund Launches Hsbc Mid Cap Fund In 2021 Smart Money Growing Wealth Asset Management

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1285353331-36a9f19d268f4aa3bf2fe93e895a6d47.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)